Practice Areas

Trust Plans, Will Plans, and Planning for Long-Term CarePLANNING AHEAD

“Should I have a Trust Plan or a Will Plan and how are they different?”

Estate Planning is what we like to call “Planning during your lifetime”. Let’s be honest – an Estate Plan isn’t for the benefit of you. An Estate plan is for the Benefit of your loved ones. You plan now so that your children or heirs don’t have to guess at what you might have wanted, fight over what you had, or absorb the confusing process and exorbitant expenses that come with dying. At Pierchoski Estate Law, we believe you have to know what ALL your options are so that you know what type of Estate Plan fits your circumstances and wishes best.

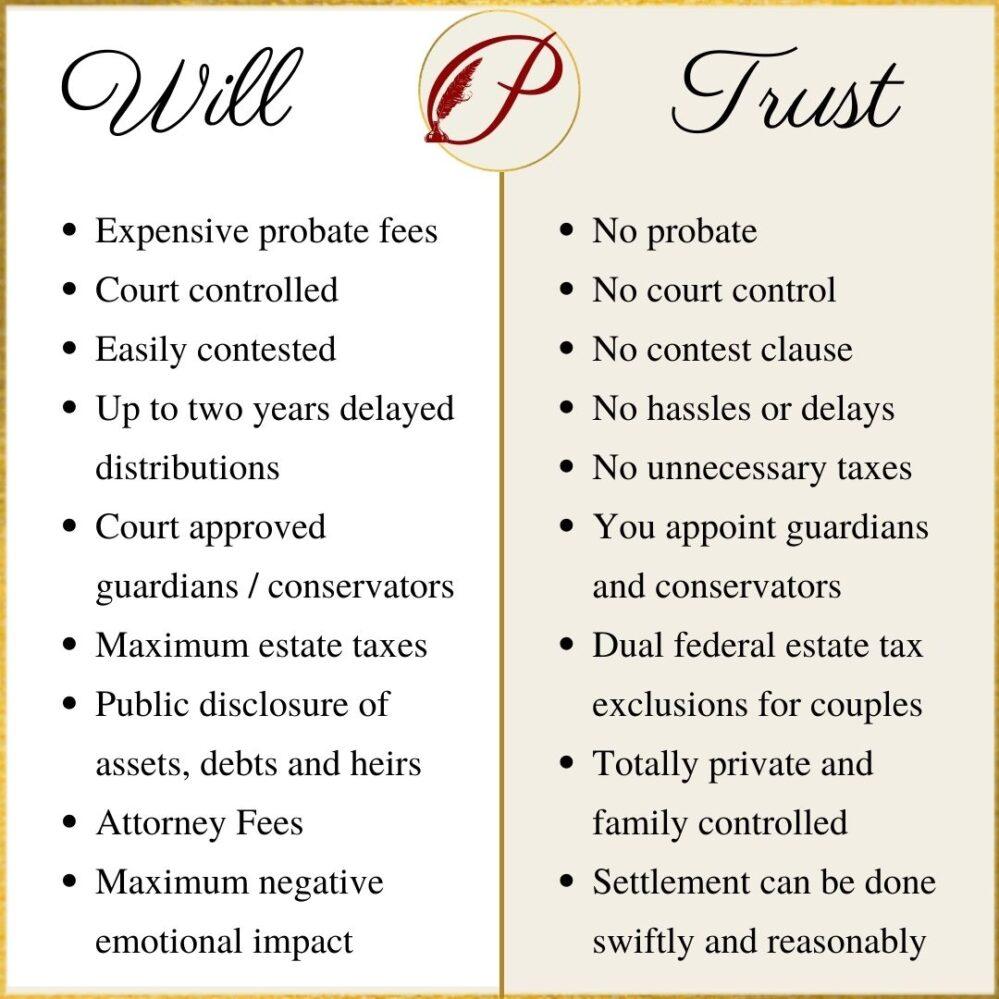

One of the most common questions we receive is “What is the difference between a Will and a Trust?” Both are Estate Planning tools but both have very different functions – it all depends on what your end goals are! That’s where we begin – what is your end goal? We answer that question with you and work backwards from there. Maybe you have condensed assets and only a single heir with no worries about the public probate process. Perhaps a Will Plan is a good fit for this circumstance. Maybe you have more complicated assets, multiple heirs, potential creditors, a child that you don’t want to disinherit but probably shouldn’t receive a large inheritance all at once…etc. Perhaps a Trust Plan is a better fit, as Trusts allow for limitless imagination when it comes to distribution and control. These are the types of things I discuss in detail at my Free Educational Seminar, which is where we encourage everyone to begin. Attending this Free Educational Seminar will provide you with clarity on your options, a look at our process, plan pricing, and more. Once you’ve attended a seminar (or viewed our pre-recorded seminar online) you are given the option to schedule a complimentary two hour meeting to discuss, in detail, your specific circumstance, wishes and desired estate planning outcomes. Both the seminar AND the two hour meeting are completely free, as we believe you should have all the information about your options before you decide what type of plan you want to put in place for your loved ones.

Estate Planning is one of the most procrastinated tasks we get around to accomplishing…or not! I invite you to my next Free Educational Seminar and encourage you to begin learning about your options today. Is it ever “too late” to begin Estate Planning? Of course not! However, we also do Medicaid Planning and Elder Law at this practice and I can say with certainty that depending on your circumstance, your options can become very limited the longer you wait!

Planning for Long-Term Care

“How do I avoid losing everything we own to the rising costs of the Nursing Home?”

One of the most common questions I see these days is “How do I avoid losing everything to the Nursing Home? In Tennessee, the cost of long-term care is over $10,000 per month. At that rate, a person’s life savings can be depleted very quickly. TennCare (Tennessee’s Medicaid program) can help offset this cost through their CHOICES benefit program. Unfortunately, there is a lot of misinformation about how you can qualify for assistance.

Did you know that approximately 70% of people age 65 and older will require some kind of long-term care at some point in their lives?

Short-term Nursing Home stays are not always people’s main concern. About 25% of all nursing home admissions are for three months or less. A short term stay like this is typically for rehabilitation after a fall, accident, or surgery, and hospice care.

Long-Term Care is what gets exorbitantly expensive very quickly. Seven out of ten people who have to enter a nursing home for long-term care will become impoverished within one year. Roughly half of all people admitted to nursing homes are there for less than one year, mainly lengthier recoveries and hospice care, while about 21% of people admitted to long-term care facilities for nursing home care stay for five years or longer.

If you’ve planned ahead with an Asset Protection trust, you can protect your home, land, and assets from being depleted to pay for long-term care or from the Estate Recovery process.

If you haven’t planned ahead and you find yourself in the position of imminent long-term care for a loved one, there is still planning that can protect a portion of, and in some cases all of, the assets. Visit our TennCare Crisis Planning page to learn more about how to plan for long-term care when you are faced with the frightening situation of paying for a nursing home.

Remember this: There is nearly always something that can be done. The sooner you become organized, take action, and have a plan, the higher the chance you can salvage a higher value of the overall estate. At Pierchoski Estate Law, all consultations for our Crisis TennCare Planning are complimentary. We will meet, discuss the options, we will provide you with an Analysis Letter that highlights the overview of the plan details, and then you and your family can decide how to move forward from there. Once again, how can you make the best decision for your family member(s) if you don’t know what options are available to you. Education is key. Reach out to us today to learn more.