You will need to understand the difference between a Will-based plan and a Trust-based plan so you can make an educated decision for your family about what is best for you and, ultimately, for them. So let’s dive into some of the main differences!

A Will-based plan is an estate plan that does not include a Living Trust to hold title to your assets. If you work with Pierchoski Estate Law and choose our Family Plan, which is a Will-based plan, your legal documents will include a Health Care Directive, Power of Attorney, a Will and, if you have minor children, a Guardianship Packet.

A Trust-based plan is an estate plan that does include a Living Trust to hold title to your assets during your lifetime and to provide for ease of transfer of those assets in the event of your incapacity or death. If you work with us and choose any of our Legacy Trust Plans, your legal documents will include all of the documents included in the Family Plan PLUS one or more Living Trusts.

So, what’s the practical difference?

One of the major differences between a Will-based plan and a Trust-based plan is that without a Trust in place your family would have to go to Court to get access to your assets in the event of your incapacity or death.

What is a Will?

Your Will indicate WHO you want to have access to those assets and how you want them distributed, but it does not keep your family out of the Court process. Your loved ones will have to go to court in a public process called Probate. Going through probate (or guardianship in the event of incapacity) is expensive, time-consuming, totally public and unnecessary. This is what happens when you have only a Will in place and not a Trust.

DID YOU KNOW – If you pass away without a Will your family will go through Probate. If you pass away WITH a Will…..they still go to Probate! A Will is a way to prepare for life after you’re no longer here but it may not be the best way for your family, depending on your circumstances. These are all things we will discuss when you meet with us. For some people, a Will is the perfect fit! For others, not so much.

Let’s Talk About a Trust

When you have a Trust in place, there is a bit more work for you to do upfront because you need to make sure that all of your assets are owned in the Trust throughout your lifetime (or insurance assets are beneficiary designated to the Trust). This is often misunderstood to be more complicated than it actually is. If you work with Pierchoski Estate Law for a Trust Plan, we will assist you with this and be available to you so you can be sure your assets are owned the right way throughout your lifetime. We want to ensure your plan stays up to date as your life changes, your assets change, and even as the law changes.

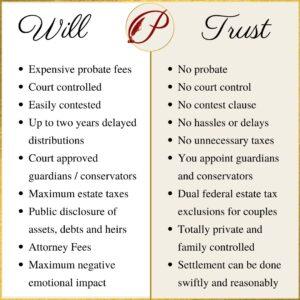

Trusts and Wills have many more differences but the MAIN pros and cons can be seen here:

During your Family Vision Meeting, we will walk you through an assessment of whether a Will-Based Plan or Trust-Based Plan is right for you based on the specifics of your family circumstances. A lot of it depends on what you own now and where you are going in the future. One thing you can be sure of is that we will help you make the right decisions every step of the way.

Call today for your appointment: 931.363.7222. Schedule a meeting with us online by clicking here.